Nigerian banks’ balance-sheet structures have helped to ensure continued compliance with minimum capital requirements despite the devaluation of the Nigerian naira by about 40% since June 2023, Fitch Ratings has disclosed.

According to the UK-based firm, the risks to capital from further currency devaluation and loan quality pressures should not affect ratings for most banks.

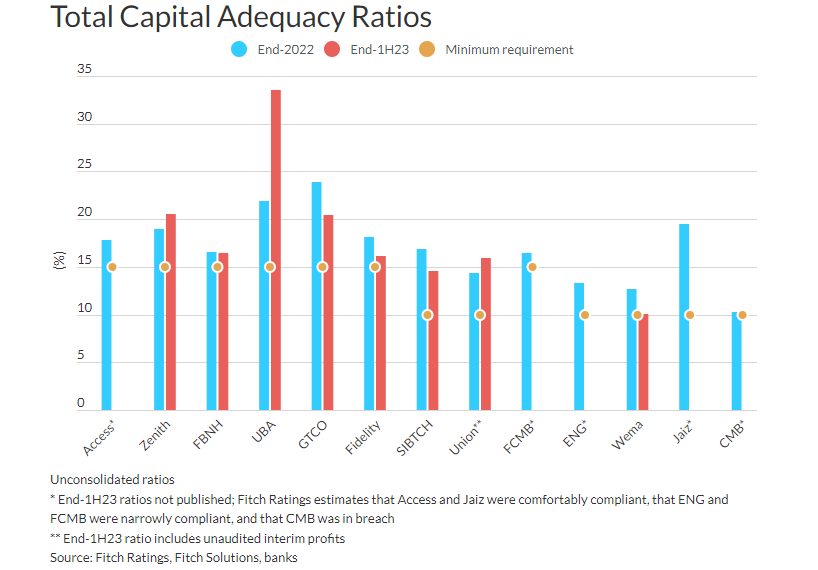

However, the Rating Watch Negatives (RWNs) on the three banks most at risk of breaching minimum total capital adequacy ratio (CAR) requirements remain in place given these risks.

The sharp devaluation of the official exchange rate led to large FX revaluation gains in the first half year due to banks’ long net open positions in foreign currency (FC), it explained.

“FC risk-weighted asset inflation was limited by small FC loan books and low risk-weights on non-loan FC assets, helping banks to remain compliant with CAR requirements. Loan impairment charges increased significantly in 1H23 due to the weaker macroeconomic setting and the increased provisions needed for FC loans, but they were comfortably absorbed by the FX revaluation gains”, it added.

It further said banks with foreign subsidiaries, in particular United Bank for Africa (B-/Stable), also experienced large FC translation gains through other comprehensive income, while the CARs of banks with FC-denominated capital-qualifying debt instruments, notably Access Bank (B-/Stable), benefitted from these instruments inflating in naira terms.

Several banks, it pointed out have had their interim financials audited so that they can incorporate their interim profits into regulatory capital. FBN Holdings, Fidelity Bank, Wema Bank and Jaiz Bank (all rated ‘B-’/Stable) plan to raise core capital to strengthen buffers over CAR requirements.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More