In recent months, Ghana’s inflation narrative has shifted from aggressive acceleration to a more measured pace. The Ghana Statistical Service continues to report declining year-on-year headline inflation, and policymakers have rightly highlighted this trend as evidence of improving macroeconomic stability. Yet, for the average Ghanaian, the lived experience tells a different story. Market prices remain stubbornly high, household budgets continue to feel stretched, and many citizens grapple with a frustrating paradox: If inflation is falling, why are goods and services still so expensive? This perception gap has deepened the belief that economic statistics and daily reality are moving in different directions. To reconcile this disconnect, it is essential to understand a crucial economic principle that is often overlooked in public discourse—the cumulative nature of the Consumer Price Index (CPI).

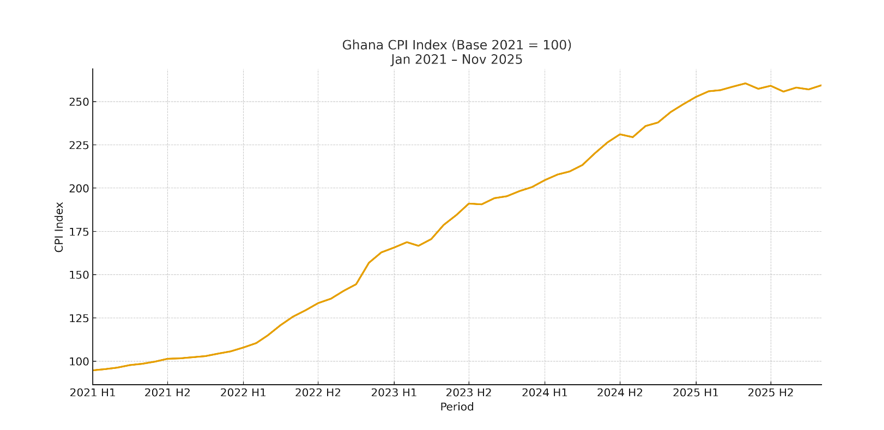

Inflation measurement using the Consumer Price Index (CPI) does not track whether prices are falling; rather, it measures how much prices have increased over time relative to a designated base year. Ghana’s CPI uses 2021 as the base year with a value of 100, and the quarterly trend from January 2021 to November 2025 shows a consistent upward movement. CPI behaves like a ladder—each additional rise becomes part of a new platform from which further increases occur. Even when inflation slows, the accumulated price increases do not disappear.

This is where the misunderstanding begins. A fall in inflation from 54% to 18% does not imply that a loaf of bread which once cost GHS 8 will return to that price after reaching GHS 20 at the height of inflation. Rather, it means the price may now rise at a slower pace from GHS 20 to GHS 21.60 instead of leaping to GHS 30. Inflation slowing is about the rate of increase easing, not prices reversing. The pain consumers continue to feel is not because inflation is currently high, but because it was once extraordinarily high, pushing prices onto a new plateau.

Ghana’s accumulated CPI reflects more than temporary shocks; it reveals years of structural price pressures. The country has experienced persistent currency depreciation, global supply chain disruptions, rising international commodity prices, and multiple tax adjustments, all of which have been passed through into consumer prices. Because Ghana remains significantly import-dependent, the exchange rate acts as a direct transmission channel for inflation. When importers pay more dollars for the same goods due to the depreciation of the cedi, reverting to previous selling prices becomes economically impossible even when inflation moderates. Businesses must also account for upward adjustments in utility tariffs, wages, transportation costs, and logistics charges, all of which become embedded in their cost structures. Once prices adjust upward, they rarely return to their original levels. They accumulate, consolidate, and become entrenched in the CPI.

This entrenchment creates a psychological contradiction. Policymakers celebrate declining inflation as a sign of progress, but households, seeing no corresponding decline in market prices, interpret the data as detached from reality. The numbers are not wrong—the interpretation is incomplete. Inflation measures a change in pace, not a reversal in direction. Prices climbed to a higher floor during the inflationary spike, and Ghana’s economy has simply stopped climbing as fast, not descended from that floor. Without this contextual understanding, public scepticism about inflation statistics persists, not because citizens distrust data, but because they misunderstand what the data represents.

Unlike advanced economies with efficient supply chains, strong competition, and diversified domestic production, Ghana lacks structural mechanisms that would naturally cause prices to fall. High post-harvest losses, logistics inefficiencies, over-reliance on imported finished goods, and energy pricing constraints prevent deflationary movements. No rational business will sell below replacement cost in an environment where the exchange rate remains volatile. Even with monetary tightening, which has helped slow price momentum, the absence of foundational reforms ensures that prices remain firmly elevated. The Bank of Ghana’s recent changes in its foreign exchange framework aim to introduce more predictability and could help reduce some of these structural rigidities, but such interventions take time to translate into perceptible market outcomes. Although headline inflation is now within the Bank of Ghana’s medium-term target band, the lingering effects of accumulated CPI continue to weigh heavily on consumers.

Ghana’s inflation story, therefore, is not just about declining rates; it is a lesson in economic memory. Prices do not forget. Every inflationary episode is archived in the CPI and remains part of the economic landscape long after the rate of change slows. To provide genuine relief to Ghanaian households, the country must move beyond celebrating numerical achievements in inflation management and confront the deeper structural issues that keep production and distribution costs elevated. The truth behind Ghana’s accumulated CPI is that inflation may be slowing, but its legacy persists. Until macroeconomic stability converges with structural reforms that reduce cost pressures across the value chain, the statistics will continue to improve while the lived reality of consumers remains largely unchanged.

Even if Ghana rebases the CPI to a new base year in 2026 and resets the index to 100, the underlying price levels accumulated over the past years will not magically disappear. Rebasing changes the reference point, not the economic reality. The high prices that have become embedded in the system remain the foundation upon which future price changes will be measured. In other words, the legacy of Ghana’s past inflation will still be felt, even if the statistical base year is refreshed.

Ernestina Mensah is a Market Risk Specialist and Economic Policy Analyst with experience in Banking and Financial Markets.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More