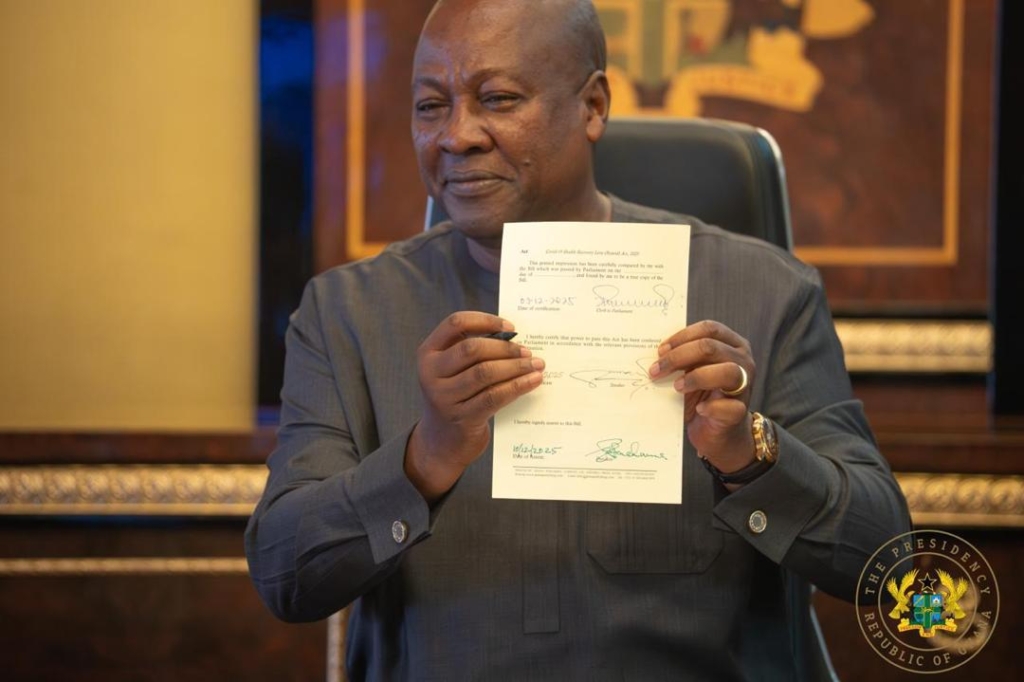

President John Dramani Mahama has officially assented to the COVID-19 Health Recovery Levy Repeal Act, 2025, effectively scrapping the one percent levy that was imposed on goods, services, and imports at the height of the COVID-19 pandemic.

The President signed the repeal on Wednesday, December 10, clearing the way for the levy’s complete removal beginning January 2026.

The repeal follows Parliament’s approval last month as part of the government’s effort to eliminate what it has described as nuisance taxes and ease the cost of living for households and businesses.

The COVID-19 Health Recovery Levy was first introduced in 2021 under the COVID-19 Health Recovery Levy Act (Act 1068), which was signed into law on 31 March 2021, as part of Ghana’s pandemic recovery measures.

The levy was designed to support government efforts in restoring health systems, financing COVID-19 expenditures, and rebuilding fiscal buffers.

The Act imposed a 1 per cent levy on the value of taxable goods and services in Ghana, as well as on imports, excluding items exempt under VAT regulations.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More