The Executive Director of the Institute of Economic Research and Public Policy (IERPPT) and the Dean, Faculty of Accounting and Finance Prof. Isaac Boadi, has called for an enhanced harmonious relationship between Bank of Ghana (BoG) and Finance Ministry (MoF).

His assertion is based on the recent simultaneous occurrence of a policy rate hike (from 27% to 28%) by BoG and a sharp decline in 91-day Treasury bill rates (from 29% to 15%).

In Ghana, the Treasury bill (T-bill) auction market is jointly managed by the Bank of Ghana (BoG) and the Ministry of Finance (MoF), but their roles differ.

The Ministry of Finance (MoF) in Ghana plays a central role in shaping the government’s short-term borrowing strategy through Treasury bills (T-bills).

The MoF is tasked with determining the total quantity of funds to be raised, which involves setting precise borrowing targets aligned with the nation’s fiscal objectives, such as addressing budget deficits or refinancing maturing debt.

For instance, the MoF may authorize the issuance of GH¢ 2 billion in 91-day T-bills to meet immediate financial obligations.

Alongside this, the Ministry oversees the maturity structure of these securities, selecting from a range of tenors, including 91-day, 182-day, and 364-day bills.

This decision on maturity mix ensures a balanced debt profile, allowing the government to stagger repayment timelines and align them with revenue generation cycles, thereby optimizing fiscal stability and liquidity management.

The Bank of Ghana (BoG) on the other hand, serves as the primary institution responsible for executing Treasury bill (T-bill) auctions on behalf of the Ghanaian government.

In this role, the BoG acts as both the issuer and auctioneer, facilitating the government’s short-term borrowing activities.

The auction process employs a competitive bidding system, where commercial banks, institutional investors, and other financial entities submit bids specifying the yield (interest rate) they are willing to accept for purchasing T-bills.

The BoG evaluates these bids sequentially, prioritizing those with the lowest yields (which correspond to the highest prices) to minimize borrowing costs for the government. This process continues until the total amount specified by the Ministry of Finance (MoF) is fully subscribed.

Once the auction concludes, the BoG establishes the cut-off yield, defined as the highest yield accepted during the bidding process.

This cut-off yield subsequently becomes the benchmark market rate for T-bills of that specific tenor, influencing broader interest rates in the financial system and reflecting investor confidence in Ghana’s fiscal stability.

By managing this structured auction framework, the BoG ensures transparency, efficiency, and alignment with the government’s liquidity and debt management objectives.

Summary of macroeconomic and financial data report by BOG

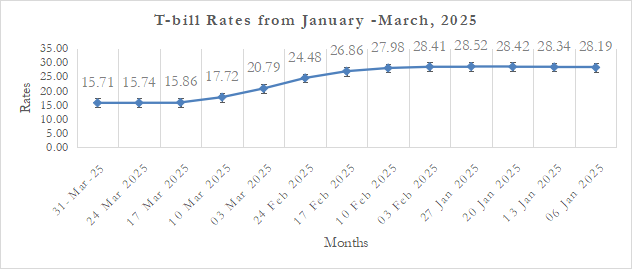

Figure 1 displays 91 Day Treasury Bills rate from January 6, 2025 to March 31, 2025. The 91 Day Treasury Bills rate dropped from 28.19% to 15.71% spanning from the period specified above.

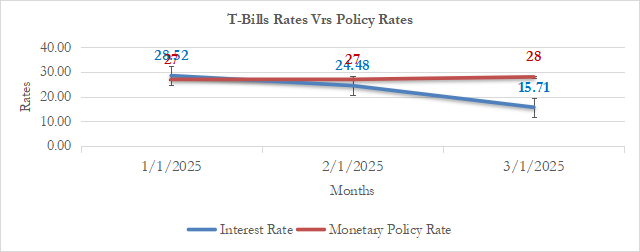

Figure 2, shows the combination of 91 Day Treasury Bills rate and a Monetary policy rate from January 2025 to March 2025. As shown in the figure 2 of the Summary of Macroeconomic and Financial Data report published in March 2025 by BoG, revealed a 91-Day T-Bill Rates fall from 29% to 15%. The same report published by BoG, indicated an increase in the policy rate from 27% to 28%.

The graph further showed that from January 2025 to March 2025, the 91-day T-bill rate reflects which a short-term government borrowing costs and investor confidence took a nose dive from 28.52% to 15.71% yielding a change of 1,281 basis points.

The monetary policy rate which is the benchmark interest rate set by the Bank of Ghana (BoG) to control inflation and stabilize the economy and guides the T-Bill rates increased from 27% to 28% resulting to change of 100 basis points.

In as much as the inconsistencies and the implications are relevant, IERPP feels it is equally important to discuss the implications of the increase in policy rates and the sharp reduction in T-Bills rates to businesses.

To start with, an increase in the monetary policy rate, signaling tighter monetary policy, significantly impacts businesses by raising borrowing costs as banks hike lending rates, forcing firms to postpone or reduce expansion plans.

Higher interest rates also dampen consumer spending, particularly in sectors like retail, real estate, and automotive, as households cut back on loans and mortgages. Businesses with variable-rate debt face inflated interest payments, squeezing profits and limiting operational cash flow.

Over time, expensive credit and weak demand stifle investments, innovation, and productivity, risking an economic slowdown as GDP growth weakens.

These effects compel businesses to prioritize financial resilience and adapt strategies to navigate a constrained economic environment.

In terms of the Treasury Bill, a sharp decline in the 91-day Treasury bill (T-bill) rate, such as falling from 29% to 15%, signals shifts in government borrowing costs and investor sentiment, with mixed implications for businesses.

While firms holding T-bills face lower risk-free returns, reducing interest income and liquidity, the drop may also indicate improved fiscal stability through lower inflation expectations and stronger confidence in economic management.

Over time, sustained low T-bill rates could lead to reduced market interest rates, easing credit access for businesses.

Simultaneously, diminished T-bill yields may push companies to reallocate funds into higher-yield investments like stocks, bonds, or internal projects. This interplay highlights how monetary conditions and market dynamics shape corporate financial strategies.

Identifying the inconsistencies

The simultaneous occurrence of a policy rate hike (from 27% to 28%) and a sharp decline in 91-day Treasury bill rates (from 29% to 15%) presents a paradoxical divergence in Ghana’s monetary policy stance.

On one hand, the Bank of Ghana (BoG) raised the policy rate to tighten liquidity, curb inflation, and discourage borrowing by making credit more expensive—a classic contractionary measure. On the other hand, the dramatic drop in T-bill rates signals excess liquidity in the financial system, as investors aggressively bid down yields despite the central bank’s tightening efforts.

This contradiction arises because, under normal circumstances, a policy rate hike should reduce money supply, driving up short-term interest rates like T-bill yields.

However, the plummeting T-bill rates suggest robust demand for government debt, possibly due to risk-averse investors flocking to safe-haven assets amid economic uncertainty, or banks channeling surplus liquidity into T-bills rather than extending riskier loans to businesses.

This inconsistency highlights a potential breakdown in the monetary policy transmission mechanism, where the BoG’s tightening measures fail to align with market behavior, raising questions about underlying fiscal pressures, investor confidence, or administrative interventions to suppress borrowing costs.

Further, a contradiction emerges when a central bank implements tight monetary policy (e.g., raising the policy rate) to combat inflation, yet market interest rates, such as Treasury bill yields, fall, contrary to expectations.

Normally, higher policy rates should reduce liquidity and lift market rates. This anomaly points to two key issues:

- Weak policy transmission, where central bank rate hikes fail to influence broader market rates due to structural inefficiencies, poor liquidity management, or eroded economic confidence.

- Market distortions, such as regulatory mandates forcing banks to buy government debt (e.g., T-bills) regardless of yields, artificially depressing rates despite monetary tightening.

Business implications of these inconsistencies

The paradoxical divergence between rising policy rates and falling T-bill yields creates a challenging environment for businesses, marked by an unpredictable cost of capital.

While firms face higher borrowing costs due to elevated policy rates, the simultaneous decline in T-bill yields introduces ambiguity in financial forecasting, complicating budget allocations and investment strategies.

This inconsistency also heightens the risk of a credit crunch, as banks, enticed by the safety of government securities, may prioritize purchasing low-yield T-bills over extending riskier loans to businesses, stifling credit access for SMEs and large enterprises alike.

The conflicting signals further fuel investment uncertainty, deterring long-term capital expenditures as firms await clarity on monetary policy direction.

However, if persistently low T-bill rates prompt the Bank of Ghana to eventually cut the policy rate, businesses could see relief through lower borrowing costs and improved credit availability.

Until then, sectors reliant on external financing, such as manufacturing and real estate, must navigate heightened volatility while balancing liquidity preservation with growth ambitions.

This misalignment risks capital misallocation and undermines the credibility of monetary policy, highlighting systemic challenges in synchronizing policy goals with market behavior.

The recent hike in the policy rate to 28% poses significant challenges for businesses by escalating borrowing costs, thereby stifling access to credit for expansion and operational needs.

Conversely, the sharp decline in the 91-day Treasury bill rate to 15%, while beneficial for the government by reducing its short-term debt burden, signals underlying market distortions and a misalignment in monetary policy transmission.

Ordinarily, a tightening monetary stance should elevate T-bill rates by constraining liquidity, yet the paradoxical drop highlights either a liquidity surplus in the financial system or a weak policy transmission mechanism, where central bank measures fail to permeate market behavior effectively.

This inconsistency underscores systemic vulnerabilities, including potential over-reliance on risk-averse investments like government securities or regulatory pressures. Skewing market dynamics, ultimately complicating economic planning for both policymakers and private enterprises.

IERPP’s Recommendations for Businesses:

Businesses are advised to adopt a prudent approach by delaying significant loan commitments until interest rates stabilize, thereby avoiding elevated borrowing costs amid ongoing monetary volatility.

To bridge funding gaps, firms should explore alternative financing mechanisms such as equity injections, trade credit, or public-private partnerships.

Concurrently, close monitoring of the Bank of Ghana’s (BoG) policy signals is critical, as sustained declines in Treasury bill yields could prompt future rate cuts, offering relief to credit-dependent sectors.

These strategies aim to enhance financial resilience while navigating uncertain macroeconomic conditions.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More