Nigerian banks have resumed the use of naira debit cards for international transactions and online payments, more than three years after financial institutions suspended the service due to acute dollar shortages.

The move by the banks signals improved dollar availability following reforms under President Bola Tinubu, who in June 2023 scrapped currency controls, increasing the flow of dollars into the economy.

GT Bank, among the largest by market value, said naira debit cards could now be used with a limit of $1,000 a quarter.

“The quarterly limit covers all transactions, including ATM cash withdrawals, purchases on international websites, POS (point of sale) payments outside Nigeria, and many more,” the bank said in a notice to customers.

Stanbic IBTC, a local unit of South Africa’s Standard Bank, said up to $500 a month could be spent on local credit cards.

Other banks, including First Bank and Wema Bank, also set a $500 monthly limit on naira debit cards.

The restoration of international card use comes as the naira has held steady this year. It was trading around 1,528 naira to the dollar on Monday, LSEG data showed.

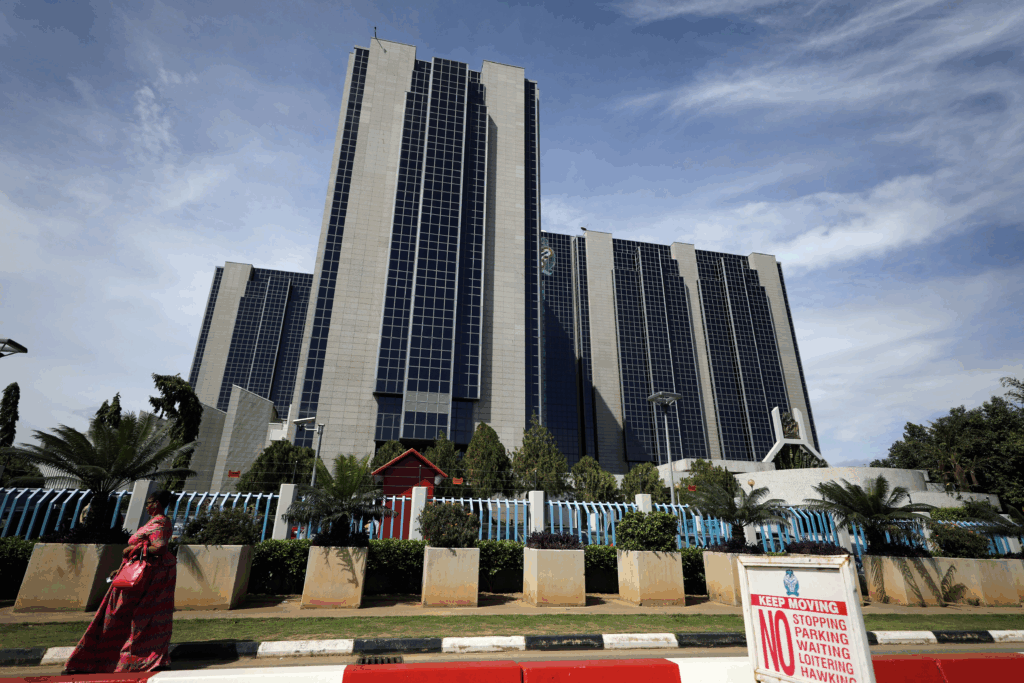

Analysts say the naira has been supported by improved reserves, which stood at $39 billion in May and higher foreign exchange inflows that increased to $28.92 billion in the first quarter of this year, according to central bank data.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More