The remarkable recovery of National Investment Bank PLC (NIB) is a direct result of the visionary leadership of President John Dramani Mahama and his bold national reset agenda.

Inheriting a bank weakened by years of financial distress, undercapitalization, and institutional neglect, the Mahama administration made good on its promise to revive NIB—not just as a banking institution, but as a critical pillar in Ghana’s industrial and economic future.

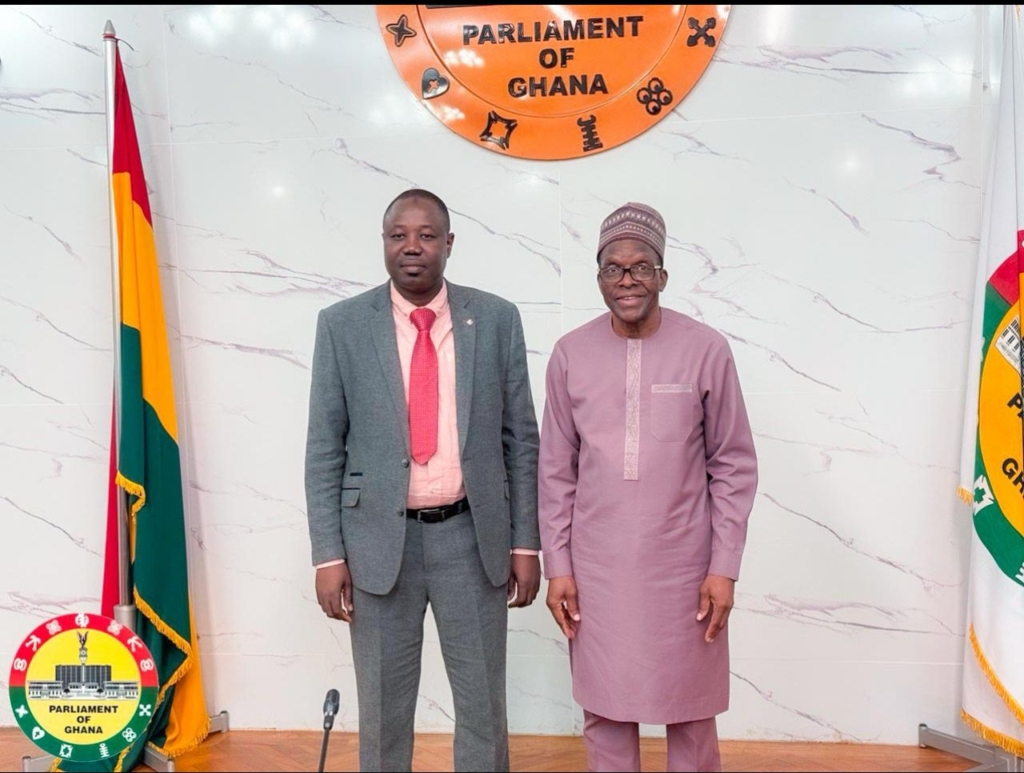

Acknowledging the urgency of NIB’s turnaround, President John Dramani Mahama appointed Chief Dr. Doliwura Zakaria as Managing Director, believing firmly that only a bold, strategic, and visionary leader could steer the bank from the brink of collapse to a new era of relevance and growth.

His appointment was not merely symbolic; it was a deliberate, high-stakes decision rooted in confidence in Dr. Zakaria’s proven capacity to deliver institutional results even under pressure. Chief Doliwura brought to the role a wealth of experience in public sector reform, financial management, and organisational transformation.

His tenure began with a clear mandate: to restore NIB’s financial stability, re-establish its industrial development focus, and rebuild public and investor confidence in the institution. What truly set him apart—and proved indispensable—was his ability to mobilise political and institutional support at the highest levels.

He is not only a dynamic corporate leader but also an accomplished academic whose intellectual depth informs his strategic approach to institutional development. With a distinguished academic background that spans finance, public policy, and governance, he brings scholarly insight to every leadership challenge.

His deep research orientation and evidence-based decision-making style have earned him respect in both academic and professional circles. Beyond academia, Chief Doliwura is widely recognised as an exceptional resource mobilizer, adept at attracting funding, forging strategic partnerships, and unlocking capital from both public and private sources.

His ability to align institutional goals with national priorities makes him a trusted figure among policymakers and development partners alike—an asset that has proven instrumental in repositioning NIB as a critical engine for Ghana’s economic transformation.

Behind the scenes, Chief Doliwura played a central role in the successful lobby for recapitalisation, working tirelessly with stakeholders across government, regulatory bodies, and development partners to communicate NIB’s strategic value to Ghana’s economy.

His deep relationships within public administration, combined with a keen understanding of policy dynamics, allowed him to frame the bank’s recapitalisation not as a bailout, but as a national investment in industrial transformation.

From high-level engagements with the Ministry of Finance to technical discussions with the Bank of Ghana and strategic advocacy within Parliament, Chief Doliwura was both the architect and chief negotiator of the rescue plan.

His ability to speak the language of both policymakers and technocrats ensured that NIB’s recapitalisation remained on the national agenda, ultimately securing the GH¢1.92 billion injection that revived the bank’s operations.

In addition to his extensive professional achievements, Chief Doliwura is a seasoned business leader with active interests in the hospitality and healthcare sectors. He also serves as a Global Peace Ambassador and is a respected member of the African Union Interfaith Dialogue Forum, where he contributes to advancing peace, unity, and cross-cultural understanding across the continent.

Today, with a restored capital adequacy ratio, renewed operational energy, and clear strategic direction, NIB’s renaissance stands as a testament not only to the government’s intervention but to Chief Doliwura’s exceptional leadership, diplomatic skill, and unwavering commitment to national development. His role in this turnaround goes far beyond the boardroom—it is a story of influence, intellect, and patriotic resolve.

This intervention was not a mere bailout—it was a purpose-driven investment in Ghana’s future. It reflects the Mahama administration’s firm belief in strengthening indigenous institutions, creating jobs, and building resilience in the financial sector. The recapitalisation forms part of a wider effort to recalibrate the economy, restore confidence in state institutions, and provide long-term, sustainable financing to key sectors such as manufacturing, agribusiness, energy, healthcare, and technology.

Today, NIB stands transformed: fully capitalised, strategically repositioned, and reenergized to deliver on its mandate. The Bank is now well-placed to support Ghana’s 24-hour economy, scale up SME financing, and be a leading partner in national development.

The Management and staff of NIB, under the leadership of Managing Director, Chief Doliwura, express their profound gratitude to President John Dramani Mahama for his decisive action and unwavering belief in the Bank’s potential. The Bank also extend heartfelt appreciation to the Ministry of Finance, the Bank of Ghana, and all stakeholders who contributed to this historic turnaround.

With renewed purpose and national backing, NIB is ready to lead the charge into a new era of industrial transformation and economic empowerment.

A Legacy Reimagined: From Distress to Renaissance

For over six decades, the NIB has stood as a key pillar in Ghana’s quest for industrialisation and economic independence. Established in 1963, NIB’s original mandate was clear: to serve as a development finance institution that would provide long-term funding to the burgeoning industrial sector of an emerging Ghana. The vision of the post-independence government was bold: build indigenous capacity, empower local enterprise, and create jobs through structured investments in manufacturing, agro-processing, and industrial innovation.

Over the years, NIB evolved to meet the needs of a growing economy. From a development finance institution, it gradually assumed commercial banking functions to better serve the private sector and deepen its footprint across the country. However, like many state-owned enterprises, the bank encountered turbulent times, burdened by years of undercapitalization, legacy debts, and operational inefficiencies. By the end of 2018, NIB’s financials showed distressing signs. The bank was saddled with over GHS 2.4 billion in non-performing loans and liabilities, pushing it into a position of financial strain that threatened its very existence.

Confidence Restored, Vision Renewed

With this full recapitalisation, NIB PLC is not just surviving—the bank is thriving. The bank has implemented a rigorous restructuring plan: modernising its digital infrastructure, streamlining operations, retraining staff, and improving risk management frameworks. Today, NIB stands as a liquid, solvent, and competitive financial institution, ready to deliver real impact.

But NIB is not stopping there. The Bank’s renewed focus is on the Ghanaian entrepreneur, the medium-scale enterprise, the start-up with potential, and the industrialist in need of patient capital. NIB is revisiting its roots—providing accessible, long-term funding tailored to support Ghana’s industrial resurgence.

NIB and Ghana’s 24-Hour Economy

One of the transformational policy directions championed by the Mahama administration is the rollout of a 24-hour economy—a bold initiative designed to boost national productivity, generate sustainable employment, and unlock economic potential across multiple sectors. At the heart of this ambitious vision is the need for reliable financial institutions that can support businesses to operate beyond traditional working hours. The National Investment Bank PLC (NIB) is proud to be a strategic driver and enabler of this agenda.

NIB has already taken a significant step forward in operationalising this vision with the opening of its new Adentan DVLA Branch, designed to support round-the-clock banking services. This branch is the first in the banking industry to be located within a 24-hour government service facility, reinforcing its commitment to delivering accessible banking that aligns with the demands of a modern economy.

The Adentan DVLA branch will not only serve customers at all hours of the day but also provide essential financial services to businesses and individuals whose work schedules extend beyond the conventional 9-to-5.

This initiative marks a paradigm shift in public service delivery, and NIB is proud to be leading the way. The Adentan model demonstrates how financial institutions can collaborate with government agencies to bring the 24-hour economy to life in practical, impactful ways.

Beyond this, NIB’s commitment to Ghana’s 24-hour economy runs deep. The Bank is prepared to finance manufacturing hubs, expand agro-processing facilities, and support logistics, healthcare, energy, and technology firms to scale operations across multiple shifts.

NIB is positioning itself as the bank for the productive class—from blue-collar factory workers to digital innovators—ensuring that Ghanaian enterprises have the capital and banking support they need to thrive in a 24-hour economy.

By bridging access to capital and offering tailored financial solutions that support extended business operations, NIB is not just supporting policy—it is shaping the future. With more than 24-hour service points planned and partnerships underway, the Bank is proud to stand at the forefront of Ghana’s economic transformation.

Restoring Public Trust, Rebuilding the Brand

NIB’s resurgence is also a story of renewed public trust. Through active engagement across traditional and digital media, corporate partnerships, and community investment, the bank is reintroducing itself to the Ghanaian public—not just as a bank, but as a partner in progress. The new customer experience strategy reflects this vision: accessible, reliable, and responsive.

Already, NIB is seeing growing deposits, increased lending activity, and strong stakeholder confidence. This is a testament to the fact that a strong public bank is not a relic—it is a necessity in a developing economy like ours.

Final Thoughts: Ghana Needs NIB Now More Than Ever

As Ghana marches forward on the path of industrialization and inclusive economic growth, National Investment Bank PLC will remain at the heart of this transformation. With a clear mandate, the backing of government, and the trust of the people, the Bank is positioned to support the nation’s boldest ambitions.

The story of NIB is one of resilience, revival, and renewed relevance. It is a reminder that public institutions, when supported and reformed, can deliver powerful outcomes for national development.

To every Ghanaian business looking for a partner, to every local manufacturer seeking financing, to every worker seeking hope—NIB is back, and it is here for you.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More