Bank of Ghana (BoG) Governor, Dr Johnson Asiama Pandit, says his vision is to build a central bank that is agile, adaptable, and prepared for future risks in a rapidly changing global financial landscape.

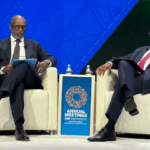

Speaking with the IMF at the ongoing IMF/World Bank Spring Meetings in Washington DC, he said the institution must evolve beyond traditional models to remain relevant and effective.

“So my mandate is clear: to achieve price and financial stability. It’s been eight months now. I believe we are on course. We are on course towards achieving that,” he said.

Dr Asiama noted that while progress has been made, some persistent challenges remain, particularly the long-standing issue of dollarisation.

“The phenomenon has been there, and so we are tackling it. You know, what can we do to make the local currency the sole legal tender?” he said.

He revealed that the Bank will mark a symbolic milestone later this month to renew confidence in the Ghana cedi.

“On the 28th of this month, we are having the Cedi at 60 celebration. The local currency will be 60 years old this year, and we want that to mark a new beginning, because when we use the local currency in all transactions, that enhances the efficiency of monetary policy.”

According to him, making the cedi the currency of choice remains one of his biggest goals.

“It’s at the core of most of our problems, and so it’s one of the things I would want to be remembered for, that I came, I solved that problem, I made the local currency the currency of choice,” he said.

The Governor stressed that an agile central bank must also be equipped to respond to new and emerging risks.

“The next thing is to have a central bank that is agile, a central bank that is ready and able to contend with the new challenges that most central banks face,” he explained.

Dr Asiama, who has spent three decades in central banking, reflected on how the industry has transformed.

“When I started my career some 30 years ago, many of the things we are seeing now weren’t there. For example, fintechs. We did not have fintechs those days, but I believe that if not handled properly, fintechs, for example, that area could be an area where a risk could emerge going forward,” he said.

He added that the Bank is taking proactive steps to manage these developments.

“We are looking at that industry well. We are mending the legislation there as well. And then you have the cryptocurrencies as well. This is another challenge for central banks. It wasn’t there 30 years ago, but I have to contend with it,” he said.

Dr Asiama emphasised that adaptability is now the defining feature of effective central banking.

“What I want to see is a central bank that is ready and able to adapt. It is critical today. It could be something else tomorrow. It could be anything, but we should have the manpower, we should have that agility, we should have the balance sheet to be able to contend with any of these risks as they emerge in the future,” he said.

He concluded that this vision — building an agile, risk-ready, and future-proof Bank of Ghana — will be the hallmark of his tenure.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More