JPMorgan Chase & Co. won the bidding to acquire First Republic Bank in an emergency government-led intervention after private rescue efforts failed to fill a hole on the troubled lender’s balance sheet and customers yanked their deposits.

JPMorgan will take over First Republic’s assets, including about $173 billion of loans and $30 billion of securities, as well as $92 billion in deposits. JPMorgan and the Federal Deposit Insurance Corp., which orchestrated the sale, agreed to share the burden of losses, as well as any recoveries, on the firm’s single-family and commercial loans, the agency said early Monday in a statement.

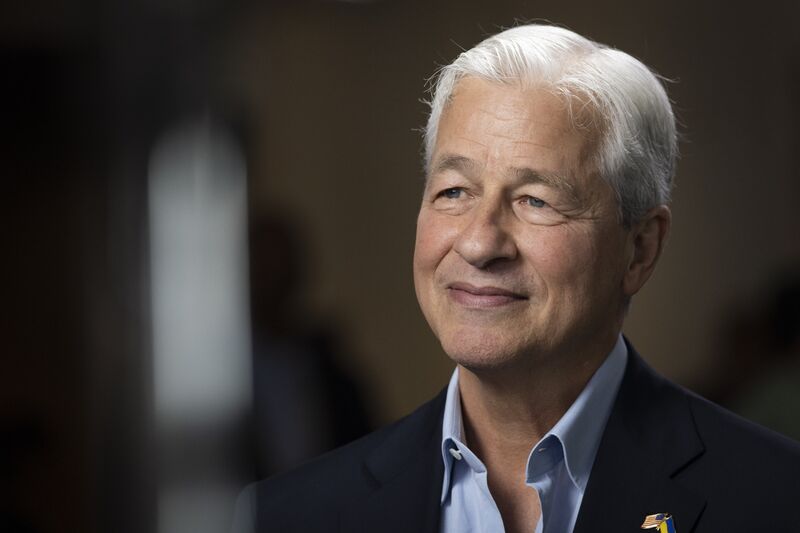

“Our government invited us and others to step up, and we did,” JPMorgan Chief Executive Officer Jamie Dimon said in a statement.

“Our financial strength, capabilities and business model allowed us to develop a bid to execute the transaction in a way to minimize costs to the Deposit Insurance Fund.”

Shares of First Republic tumbled more than 33% by 4:06 a.m. in New York during premarket trading, putting it on track to extend this year’s 97% slump. JPMorgan’s stock rose 3.8%.

The transaction makes JPMorgan, the nation’s largest bank, even more massive — an outcome government officials have taken pains to avoid in the past. Because of US regulatory restrictions, JPMorgan’s size and its existing share of the US deposit base would prevent it under normal circumstances from expanding its deposit base further via an acquisition. And prominent Democratic lawmakers and the Biden administration have chafed at consolidation in the financial industry and other sectors.

JPMorgan expects to recognize a one-time gain of $2.6 billion tied to the transaction, according to a statement. The bank will make a $10.6 billion payment to the FDIC and estimated it will incur $2 billion in related restructuring costs over the next 18 months.

The $92 billion in deposits includes the $30 billion that JPMorgan and other large US banks put into the beleaguered lender in March to try to stabilize its finances. JPMorgan vowed that the $30 billion would be repaid.

For the $173 billion in loans and $30 billion in securities included in the deal, JPMorgan and the FDIC entered into the loss-sharing agreement to cover single-family residential mortgage loans and commercial loans, as well as $50 billion worth of five-year, fixed-rate term financing.

Assets Agreement

The FDIC and JPMorgan will share in both the losses and the potential recoveries on the loans, with the agency noting it should “maximize recoveries on the assets by keeping them in the private sector.” The FDIC estimated that the cost to the deposit insurance fund will be about $13 billion.

“We should acknowledge that bank failures are inevitable in a dynamic and innovative financial system,” Jonathan McKernan, a member of the FDIC board, said in a statement. “We should plan for those bank failures by focusing on strong capital requirements and an effective resolution framework as our best hope for eventually ending our country’s bailout culture that privatizes gains while socializing losses.”

JPMorgan said even after the deal, its so-called common equity tier 1 capital ratio will be consistent with its first-quarter target of 13.5%. The transaction is expected to generate more than $500 million of incremental net income a year, the company estimated.

Marianne Lake and Jennifer Piepszak, co-CEOs of JPMorgan’s consumer and community banking unit, will oversee the acquired First Republic business.

“First Republic has built a strong reputation for serving clients with integrity and exceptional service,” Lake and Piepszak said in the statement. “We look forward to welcoming First Republic employees.”

JPMorgan was a key player throughout First Republic’s struggles. The bank advised its smaller rival in its attempt to find strategic alternatives, and Dimon was key in marshaling bank executives to inject the $30 billion in deposits.

First Republic specializes in private banking that caters to wealthier people, much like Silicon Valley Bank, which failed in March, focused on venture capital firms.

Chairman Jim Herbert started the lender in 1985 with fewer than 10 people, according to a First Republic history. By July 2020, the bank said it ranked as the 14th-largest in the US, with 80 offices in seven states. It employed more than 7,200 people at the end of last year.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policies of Homebase Television Ltd.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More