Goldman Sachs Research is forecasting that the price of gold will rise 6% through the middle of 2026 to $4,000.

This is underpinned by fresh demand from key groups of buyers who have contributed to a series of record price highs.

Gold has risen more than 40% in 2025 and is on pace for its third straight year of double-digit gains.

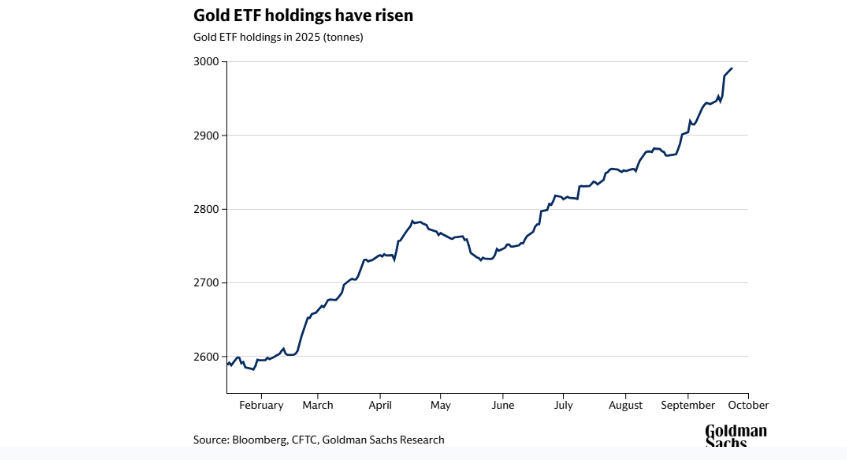

Goldman Sachs’ forecast is driven by strong structural demand from central banks and easing from the US Federal Reserve which supports demand for gold from exchange-traded funds.

The buyers of gold fall into two broad groups, according to Goldman Sachs Research.

Conviction buyers tend to purchase gold consistently, regardless of the price, based on their view of the economy or to hedge risk. These include central banks, ETFs, and speculators. Their thesis-driven flows set the price direction.

As a rule of thumb, every 100 tonnes of net purchases by these conviction buyers corresponds to a 1.7% rise in the gold price.

By contrast, opportunistic buyers such as households in emerging markets step in when they believe the price is right. They may provide a floor under prices on the way down and resistance on the way up.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More