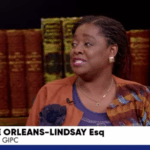

Head of the Legal Division at the Ghana Investment Promotion Centre (GIPC), Naa Lamle Orleans-Lindsay Esq., has raised concerns over the rigidity of Ghana’s investment laws, particularly the blanket capital requirements imposed on foreign investors.

Speaking on JoyNews’ legal affairs programme The Law, Ms Orleans-Lindsay highlighted the limitations of the current legal framework, which she said no longer reflects best practice or meets the needs of a dynamic investment climate.

“We have the current law that we work with; it was passed in 2013, so it’s about 12 or so years old,” she noted, referencing the GIPC Act, 2013 (Act 865). “The law before that was passed in 1994. Capital requirements were increased significantly in 2013.”

According to her, after over a decade of applying the law, it has become clear that Ghana’s approach to foreign investment regulation is increasingly out of step with international norms.

“After managing the law for a little over a decade, we have realised that we are a lone voice in the wilderness, as it were, when it comes to the way our capital requirements are structured,” she remarked.

Unlike other jurisdictions that differentiate requirements based on the type and scale of business, Ghana’s investment legislation imposes fixed capital thresholds across the board a system she described as “rigid”.

“We have blanket capital requirements, which means that irrespective of the type of business, it doesn’t matter. It’s rigid,” she said. “That’s the key difference between how the law works in Ghana and elsewhere.”

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More