A JoyNews Research Analysis:

Ghana is undergoing a dramatic shift in its energy landscape, with thermal power increasingly displacing hydro as the country’s primary source of electricity. But this transition comes at a steep cost — both financially and structurally — as Independent Power Producers (IPPs) who dominate the thermal space are reportedly owed over $2.5 billion by the government.

From Water to Fire: A Two-Decade Transition

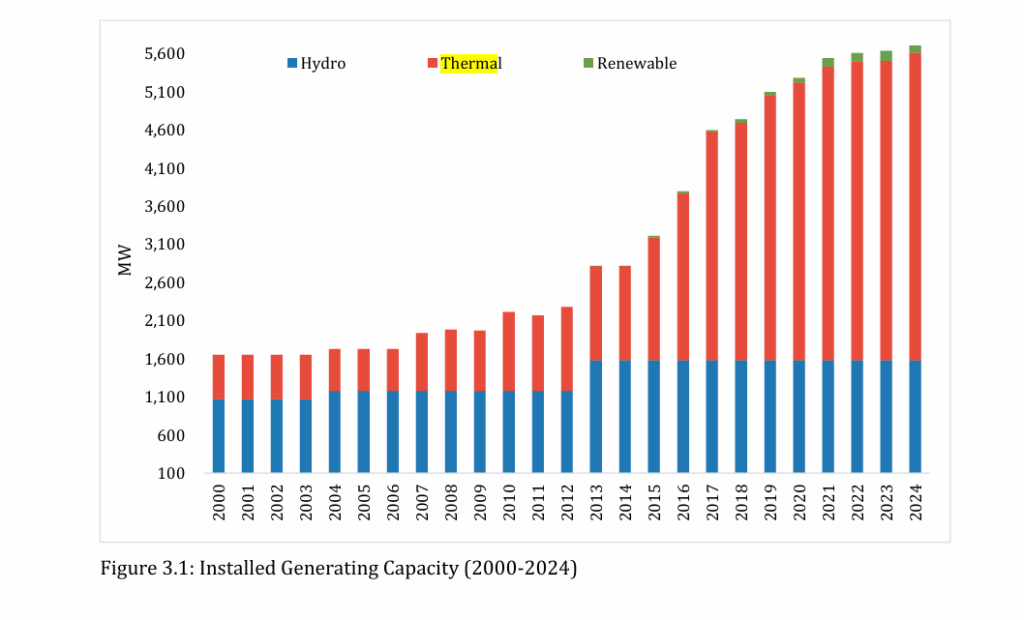

Data from the Energy Commission’s latest report on Grid Installed and Dependable Capacity (2000–2024) illustrates a telling trend. In 2000, thermal sources accounted for just 580 MW of installed capacity compared to 1,072 MW from hydro. Fast forward to 2024, and the numbers have flipped: thermal capacity now stands at 4,032 MW, dwarfing hydro’s 1,584 MW.

This seismic shift has implications for how Ghana powers homes, businesses, and industries. Hydro, once a cornerstone of Ghana’s energy independence, has plateaued. Meanwhile, thermal has more than sextupled, fuelled largely by investments from IPPs and a push to stabilize power supply during frequent shortages in the early 2010s.

The IPP Dilemma: Heavy Reliance, Heavier Debt

The rise of thermal power is closely tied to Ghana’s engagement with IPPs. These private sector players stepped in during the power crisis of the mid-2010s, setting up plants that now form the backbone of the country’s dependable thermal generation.

But their involvement has also created a financial quagmire. Former President John Mahama recently revealed that the state owes IPPs and fuel suppliers an estimated $2.5 billion — a figure that highlights the unsustainable nature of the country’s current energy financing model. Most of these contracts are take-or-pay, meaning the government pays for power whether it uses it or not.

In fact, thermal power has taken over the nation’s generation mix, but it comes at a high price — especially in forex and arrears as Ghana burning more gas, importing more fuel, and piling up debt.

Dependable but Costly: What the Numbers Say

In 2024, Ghana’s total installed generation capacity reached 5,749 MW, with thermal alone contributing 70% of that. In terms of dependable capacity — the actual output plants can reliably deliver — thermal again leads with 3,695 MW out of the total 5,211 MW.

Hydro has remained mostly stagnant over the past decade, contributing just 1,411 MW to dependable capacity this year — only a modest increase from 1,040 MW in 2000.

Despite efforts to integrate renewable energy, other sources like solar and waste-to-energy technologies contribute a mere 133 MW installed and 106 MW dependable capacity, making them virtually negligible in the broader energy mix.

Fuel Imports and Forex Pressure

Thermal power generation requires the steady importation of natural gas and other fuels, exposing Ghana to fluctuations in global energy markets. This has created foreign exchange pressures, with the government struggling to keep up with payment schedules, especially when the Ghana cedi depreciates.

Gas agreements with partners like Nigeria and investments in liquefied natural gas (LNG) terminals have tried to alleviate the problem, but delays in payments and infrastructure constraints persist.

The forex pressure is real as Ghana continues paying IPPs in dollars while collecting electricity tariffs in cedis. This is definitely not a sustainable model!

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More