Ghana’s economic growth in 2026 will remain strong, underpinned primarily by resilient household demand despite a slowdown in economic activities in quarter three of 2025.

According to Fitch Solutions, domestic demand will remain strong in the coming quarters, supported by muted inflation and easing interest rates alongside a more expansionary fiscal stance.

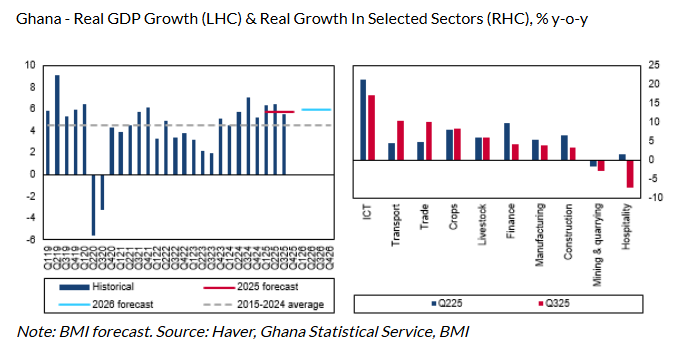

“We project economic momentum in Ghana to remain robust, with real GDP [Gross Domestic Product] growth edging up from 5.8% in 2025 to 5.9% in 2026. The latest data from Ghana Statistical Service shows that economic activity softened slightly in Q3 [quarter 3], as growth slowed to 5.5% year-on-year from 6.5% in Q2 [quarter 2]. This was largely due to weaker performance in the industrial sector, where growth fell from 2.3% in Q2 to just 0.8% in Q3, caused by a deeper contraction in mining and quarrying and easing construction activity”.

“Services growth also moderated, slipping from 9.6% to 7.6%, as the ICT expansion cooled despite solid gains in domestic trade and transport. In contrast, growth in agriculture accelerated, rising from 7.1% in Q2 to 8.6% in Q3, supported by strong crop production and buoyant activity in the fishing industry”, it stated.

Fixed Investments to be Key Driver of Growth

The Uk-based firm highlighted that fixed investment will also remain a key driver of growth in 2026.

According to the firm, the Bank of Ghana’s historic easing cycle – which has already seen 1,000 basis points worth of cuts since mid-2025 – will feed through to the real economy and support a recovery in private-sector borrowing after three years of weakness.

It added that investment activity will also benefit from the anticipated implementation of the Public–Private Partnership Act and the Corporate Insolvency and Restructuring Act, which should strengthen the regulatory environment.

Additionally, the recapitalisation of the National Investment Bank and the Agricultural Development Bank is set to enhance Small and Micro Enterprises access to finance, adding further momentum to private-sector investment.

Capital Expenditure Set to Rebound

It continued that the public-sector capital expenditure is set to rebound after a notably weak 2025.

“Ministry of Finance data shows that development spending contracted by 48.3% in the first seven months of 2025 (latest available data). However, the 2026 budget signals a sharp reversal, with the government having allocated GH¢30.0 billion (US$2.6 billion) to the Big Push Infrastructure Programme – up from GH¢13.8 billion in the revised 2025 budget – which includes major projects such as the Accra–Kumasi Expressway and the Eke Amanfrom–Adawso Bridge. This will provide a boost to construction activity and overall fixed capital formation”.

It forecasted fixed investment to grow by 10.0% in 2026, contributing 1.5 percentage points to headline economic growth.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More