The Ghana Union of Traders’ Associations (GUTA), has expressed disappointment in the tax reliefs granted by the government in the 2024 budget presented to Parliament on Wednesday, November 15.

In the view of GUTA, the reliefs granted do not have far-reaching consequences as it will positively impact a handful of businesses and the citizenry.

The Finance Minister, Ken Ofori-Atta during his presentation of the 2024 budget statement in Parliament announced some measures to cushion businesses and Ghanaians in general.

Some reliefs prioritized by the government include the extension of the zero rates of VAT on locally manufactured African prints, sanitary pads and locally assembled vehicles, as well as waivers on import duties for electric vehicles and agricultural machinery.

To address environmental concerns, Mr Ofori-Atta announced the government’s plan to expand the Environmental Excise Duty to cover plastic packaging, industrial emissions, and vehicle emissions.

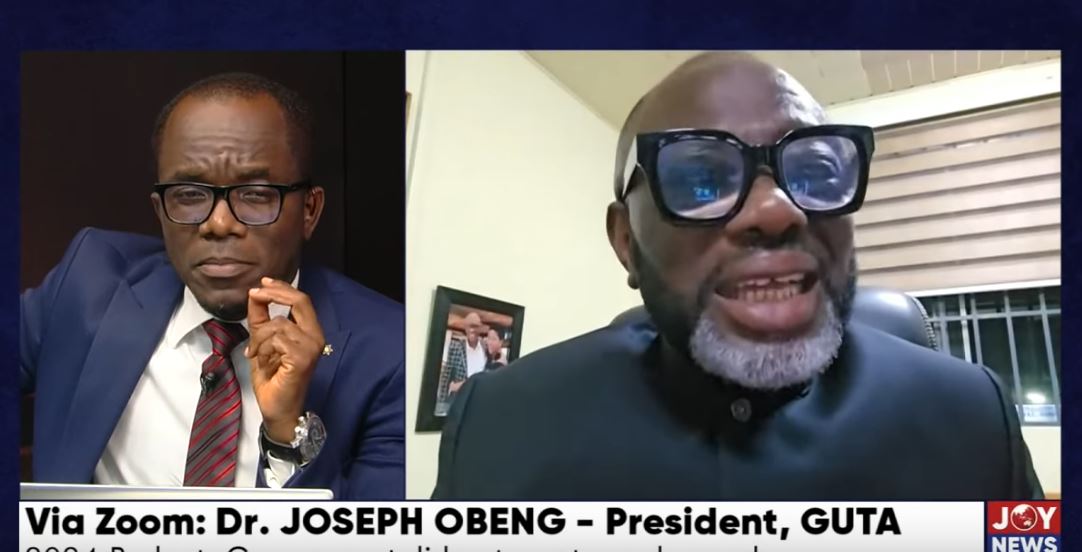

Speaking on JoyNews’ PM Express on Wednesday, November 15, the President of GUTA, Dr Joseph Obeng said although GUTA was consulted prior to the budget presentation, its inputs were not taken.

[embedded content]According to him, businesses will still struggle since most of the challenges they face remain unchanged.

“We were consulted and we gave our inputs and we thought that they were going to be considered because we made very meaningful inputs, but our demands were not met especially those of us in the trading community.”

“But admittedly, some segment of the business community have gotten some reliefs and these reliefs are also positive. When you look at the relief for agric machinery, relief on raw materials for pharmaceuticals, relief for African prints, those of electric cars and all that, these are positive but they’re in the minority “he noted.

Dr Obeng mentioned that the high cost of doing business will remain the same since only a fraction of businesses have been granted the reliefs.

If you look at the general cost of doing business in this country and what we were seeking, then of course I will say that the status quo remains. The cost of clearance at the port and all that everything still remains. The high rate of taxes that we are made to pay, the number of taxes that have been imposed on us, all of these have not been addressed although just a fraction that has gotten the relief, but on a broader scale I must say the status quo remains the same, and most companies are going to fall,” he lamented.

He questioned why the government insists on keeping levies such as the COVID-19 levy when the pandemic is no more.

“We also demanded that the COVID levy should be removed because it’s a nuisance tax. There’s nothing nuisance than the COVID levy. It came to solve a specific purpose and it should be out of the table. It’s as simple as that” he argued.

Dr Obeng rubbished the suggestion that government is keeping the COVID-19 levy to offset the debts that were accumulated as part of measures to deal with the pandemic.

In response to that argument, he said “But we also know that some funds also came in, and we also know that the COVID pandemic came to destroy businesses. Has that also been taken into consideration; and that the pandemic that has come to destroy businesses, we impose levies on the same businesses.

“There’s no precedent anywhere in the world. And those countries did they also not incur cost in combating the pandemic.? We have to weigh and assess the issues properly to know whether we are being treated fairly”he noted.

The Special Import Levy is still on the table after it had been introduced with the same reason that we had a special problem, and that the business community should allow; that was introduced by the previous government. If we do this, it means that the business community is not going to have confidence and trust in leadership because you can’t say that something is temporary and then it becomes a tax in perpetuity when businesses are collapsing and have been overtaxed. It is not fair,” Dr Obeng bemoaned.

According to the GUTA President, these situations leave businesses with no other choice than to pass the cost onto consumers.

Now we don’t have any reliefs, and the natural thing is to pass the cost to the consuming public. But how are we going to do that where consumers are also being eaten away with their purchasing power by the effects of inflation. How are they going to even absorb this cost; and so what happens eventually is that we lose our capital. This is what is going to happen,” he noted.

Dr Obeng also criticized the current structure of the Value Added Tax (VAT), saying there’s no fairness in the current system, blaming it for the confusion that usually exists between traders and the Ghana Revenue Authority (GRA).

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More