ARB Apex Bank PLC has maintained a strong financial performance for the 2024 fiscal year, recording a Profit Before Tax of GH¢25.44 million.

The bank clocked growth across key indicators, including a 37.3% increase in capital, an 83.87% rise in total assets, and a 73.66% surge in deposits.

This marks a steady recovery from the adverse impacts of the Domestic Debt Exchange Programme (DDEP) that began in 2022.

The Ghanaian banking industry is bouncing back in the aftermath of the economic downturn experienced in 2022, with the rollout of the Domestic Debt Exchange Program (DDEP) under the previous administration.

The sector demonstrated significant growth in key financial indicators during 2024.

Rural banks made remarkable breakthroughs in digital banking with the adoption of online banking that greatly enhanced convenience and accessibility for rural customers.

At the 23rd annual general meeting of the ARB Apex Bank PLC, the manifestation of this growth was tabled for the year 2024.

ARB Apex Bank PLC oversees the operations of 147 rural and community banks with over 800 branches.

Financial Performance

Despite the dynamic and challenging macroeconomic climate, the Bank’s total assets recorded significant growth of 83.87 percent from GH¢1.24 billion in 2023 to GH¢2.28 billion in 2024.

With prudent management after the negative impact from the DDEP participation, the Bank has turned the negative shareholders’ funds of GHS32.4 million as at the end of December 2023 to positive GHS49.5 million as at December 2024.

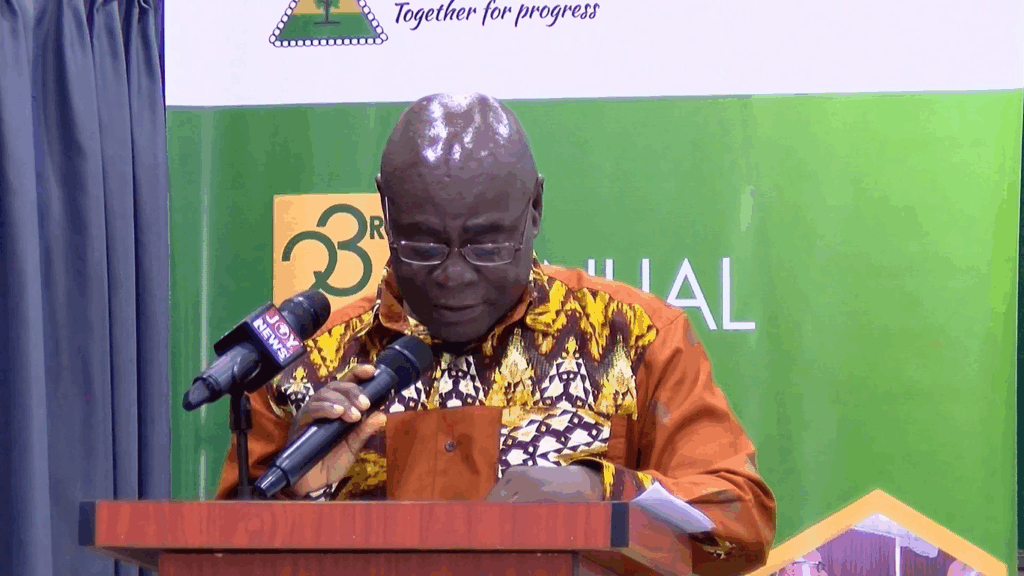

Chairman of the ARB Apex Bank PLC, Daniel Ohene K. Owusu, assures that ARB Apex Bank will continue with all the efforts to improve quality service, governance, internal controls, and financial performance.

“As part of this effort, the Bank will not relent on its engagement with the regulator and relevant government officials to address the apparent operational challenges facing the industry. Esteemed Shareholders, the conclusion of the 2024 financial year marks a point of reflection. Moving forward, our expectations will be founded on the prospective gains anticipated in future economic dynamics. In the years ahead, the global economy is projected to grow by 3.3 percent in both 2025 and 2026,” he said.

Investments at the bank increased by 24.38 percent from GHS510.1 million in 2023 to GHS634.5 million in 2024, whilst loans and advances recorded a higher growth of 104.87 percent to GHS121.9 million from GHS59.5 million in the same period.

This reflects a robust institutional and leadership strategy that ensured recovery from the defects of the Domestic Debt Exchange (DDEP).

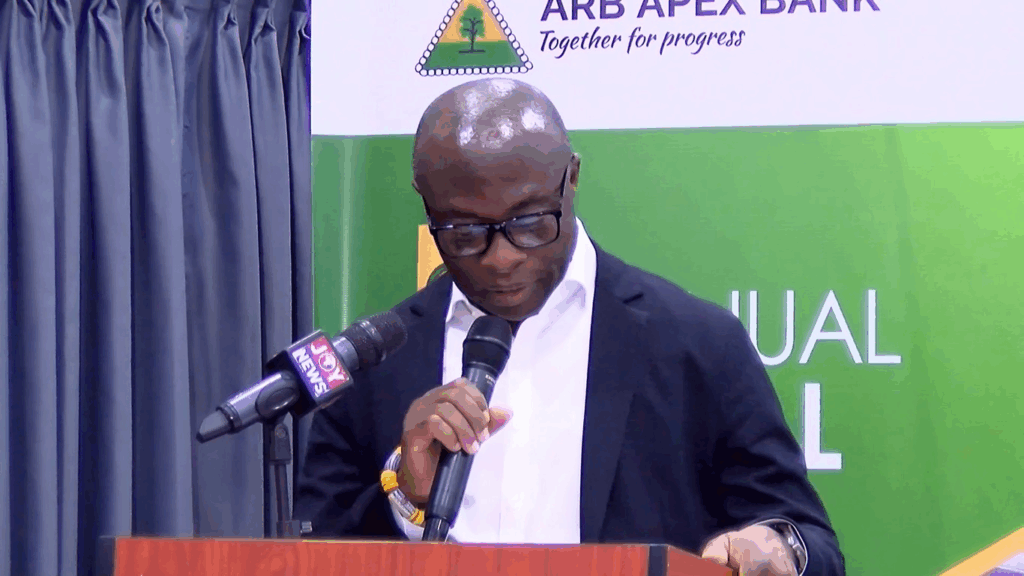

Managing Director of ARB Apex Bank PLC, Alex Kwasi Awuah, lauded internal and stakeholder strategies that have secured the bank’s elite performance.

“A consolidated 71 percent of the seven objectives outlined in the plan had been achieved as of the end of May 2025, when management undertook a comprehensive review of the Bank’s performance in the implementation of the Strategic Plan.

“Our exceptional financial performance this year is a testament to the efficacy of the strategies we have implemented over the past three years, which should provide our esteemed shareholders the comfort as we are now on the brink of achieving greater heights for them,” he said.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More