Ghana’s renegotiated lithium mining lease has finally reached parliament after a long delay. It is now before the committee on lands and natural resources for scrutiny before any possible approval and eventual debate and ratification on the floor of the house.

According to the chair of the natural resources committee, Collins Dauda, the committee is in no rush to push the lease through without full stakeholder engagement.

The majority on the committee also notes that the 2026 budget debate is ongoing in the house, meaning the lithium lease may not be submitted until next year.

This slower pace is commendable as public scrutiny is essential, and resource governance in Ghana has long suffered from poor utilization of the rents paid by mining companies.

At a media briefing on November 25, 2025, the majority on the committee attempted to clarify speculation about revisions to the fiscal terms of the lithium lease.

When the agreement was first signed in 2023, Ghana secured a royalty rate of 10%. The lease also required that 1% of total revenue, not profit, be allocated to a community development fund for affected areas.

In addition, the government secured a 13% free carried interest along with ground rent, a growth and sustainability levy, mineral rights fees and a 35% corporate income tax.

Together, these were expected to produce an effective tax rate of about 58%.

During the briefing, the majority on the committee revealed that the royalty rate had been revised from the originally negotiated 10% to what it described as “prescribed by law”.

The lease now states that “The Company shall pay to the Government royalty as prescribed by law.”

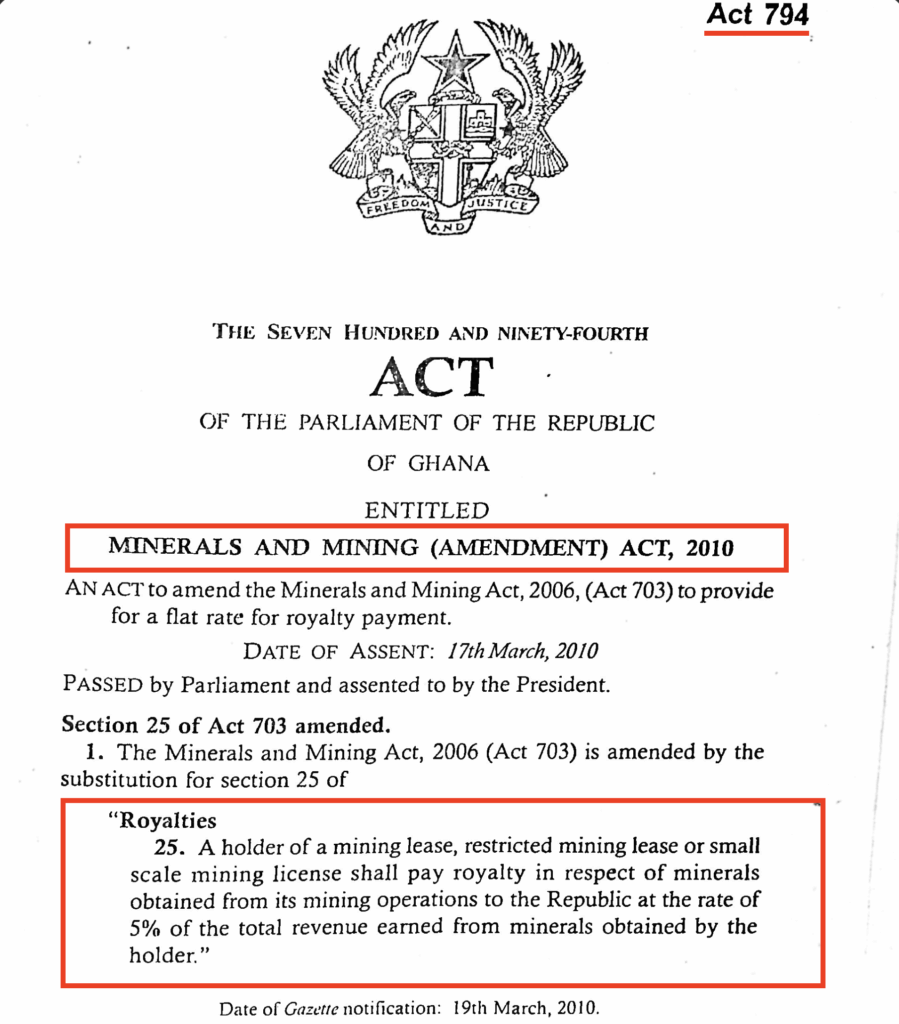

According to the committee, that prevailing rate is 5%, based on a 2010 amendment to Ghana’s mining act.

The majority on the committee argues that the government will need to amend the mining laws to revise the prevailing royalty rate from 5% upwards to 10 or 12% so that the 10% rate can be applied to lithium.

Because the lease does not specify a fixed rate, they maintain that amending the law will be the proper approach.

As the committee chair put it, “Revenues generated from a 5% royalty and 10% royalty can never be the same. The preference is to have 10% or more. But the law has to be amended. What it means is that this law which is the current on royalties, the minerals and mining amendment act 2010 (Act 794), has to be amended to up the rate from 5% to whatever percentage the minister so wishes.”

To assess this argument, some legal facts need to be clearly set out.

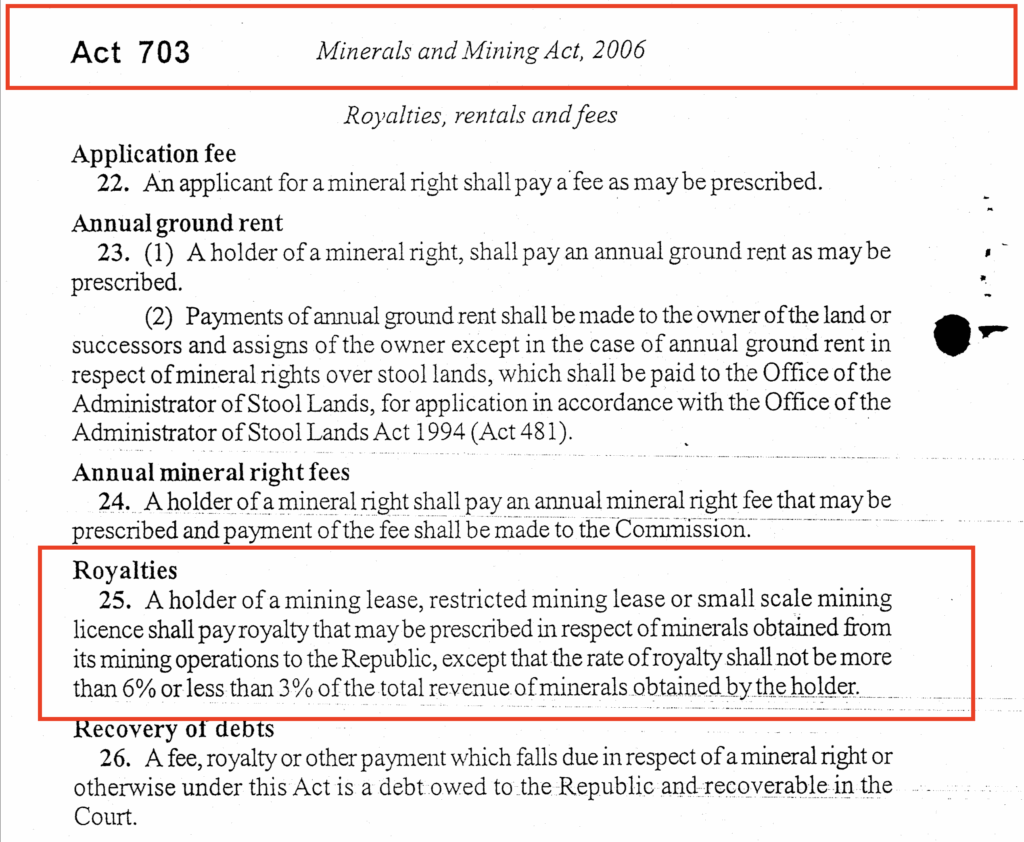

Ghana’s principal mining legislation is the Minerals and Mining Act of 2006, Act 703. Section 25 of the 2006 Act originally set royalties between 3% and 6%.

In 2010, the mining law was amended by the Minerals and Mining Amendment Act, Act 794, which altered section 25 and fixed Ghana’s royalty rate at 5%.

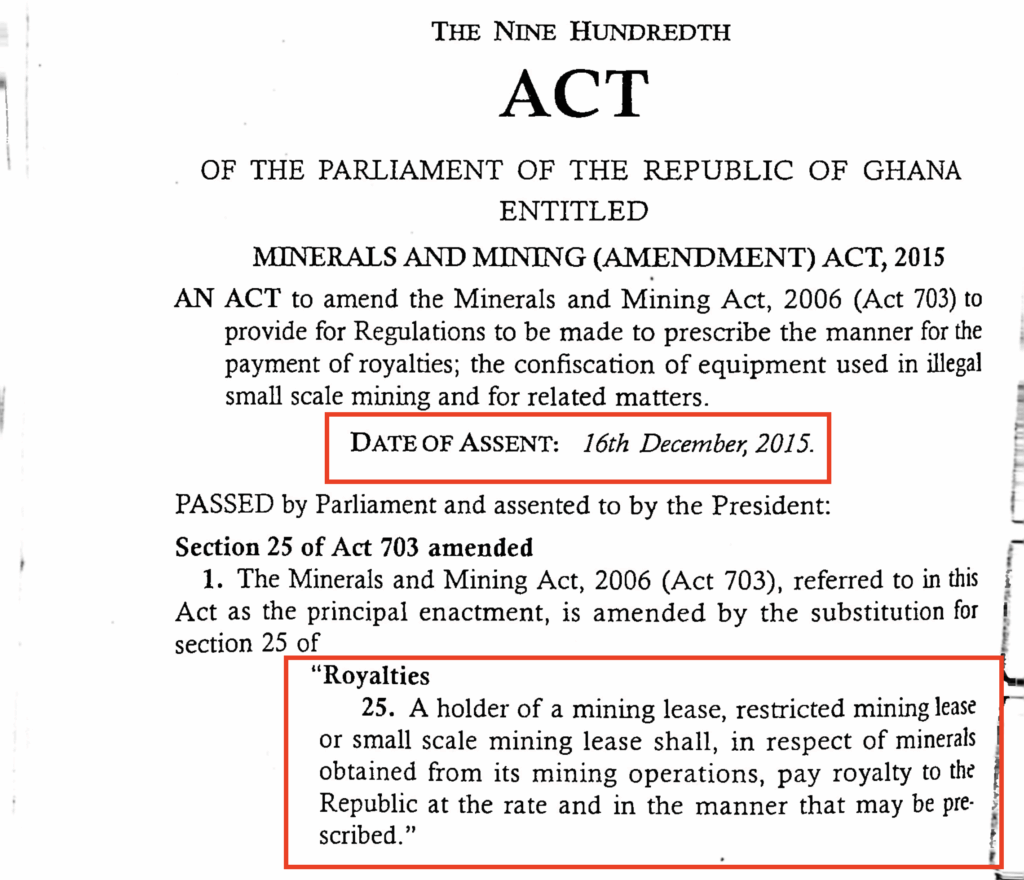

The majority on the committee correctly notes the existence of the 2010 amendment. However, they do not acknowledge that the law was amended again in 2015 by Act 900.

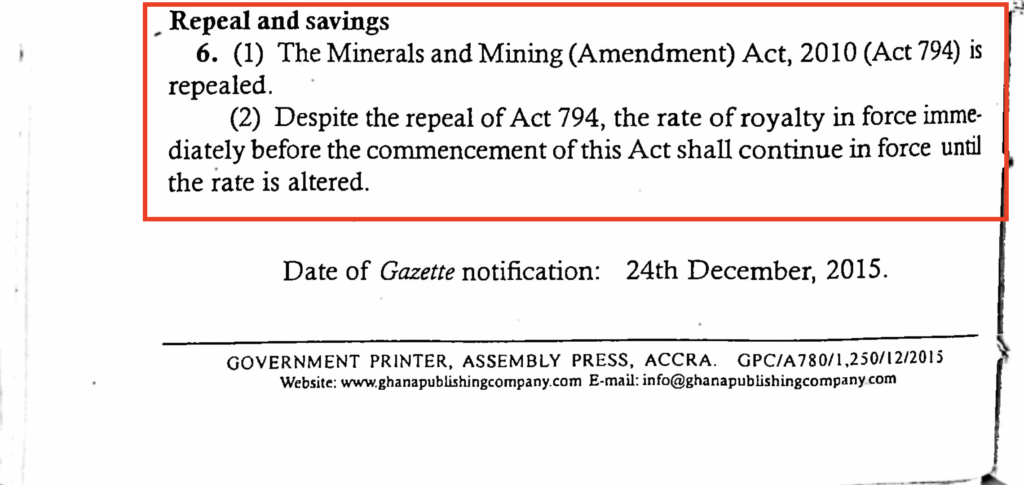

This amendment explicitly repealed Act 794. The repeal meant that the fixed 5% rate was no longer a statutory requirement.

Act 900 introduced a new framework under which royalties are to be set “at the rate and in the manner that may be prescribed”, giving the Minister responsible for lands and natural resources authority to propose royalty rates through formal regulations.

Crucially, Act 900 also contains a savings clause which states: “Despite the repeal of Act 794, the rate of royalty in force immediately before the commencement of this Act shall continue in force until the rate is altered.”

This savings clause means that the 5% general royalty rate remains in force until a new regulation alters it. Royalty rates are therefore now to be set by regulations, not fixed in the Act.

The 5% is not required by law in the same way Act 794 required it. It is only the current rate by default, waiting to be replaced through the regulation making process, which requires consultation and parliamentary oversight.

At the same time, some interpretations of the law and Act 900 hold that the Minister may negotiate special royalty terms for individual leases. These terms only become binding once parliament ratifies the lease.

This mechanism would allow specific companies to pay rates above the general 5%, such as 10%, without changing the royalty rate for all mining companies.

According to this alternate interpretation, such arrangements would not violate the default 5% rate and would not require the government to amend the law before applying a higher rate to a specific project.

Most existing mining leases in Ghana relate to gold and other well-established minerals. Lithium is a new mineral class, and the state may negotiate higher royalties where the circumstances justify it.

The real question is therefore a policy choice.

Ghana can either enact new regulations that raise royalty rates for all minerals, create a range such as 5% to 12% and leave negotiations to the sector ministry, or maintain the general 5% rate while allowing a 10% rate for lithium through parliamentary ratification.

The committee has assured the public that there will be extensive deliberations and that no hasty approval will occur. Any necessary amendments or regulations will be pursued before the committee submits its report to the full house.

Even so, the shifting explanations about what the law requires and what parliament must do risk creating uncertainty. Too much uncertainty could deter the investment Ghana hopes to attract in the mining sector.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More