The IMF has confirmed that the Bank of Ghana has incurred some losses through the Gold for Reserves programme implemented via the Ghana Gold Board.

In its 5th review of Ghana’s ongoing IMF programme, the Fund disclosed that losses from the artisanal and small scale doré gold transactions under the programme had reached $214 million by the end of September 2025.

At current exchange rates, this amounts to about ₵2.43 billion.

As the IMF noted, “In 2025 through end Q3, losses from the artisanal and small scale doré gold transactions component of G4R have reached US$214 million (0.2 percent of GDP), mostly on trading losses but also on GoldBod off takers’ fees.”

While GoldBod itself has indeed recorded profits, those gains have come at the expense of the central bank, which has absorbed the bulk of the losses generated by the programme.

The IMF has warned that this arrangement poses risks to the Bank of Ghana’s financial position, stating plainly that “the domestic gold purchase programme poses risks to the financial sustainability of the BoG.”

Understanding how these losses emerged requires a closer look at how GoldBod operates.

When the Gold Board was established, its initial business model was to act as the sole buyer and exporter of gold from Ghana’s small scale mining sector.

It was to be funded by a $279 million revolving fund provided in the 2025 budget. That model has since changed.

By the end of September 2025, GoldBod had not received the budgeted funds and now operates primarily as an intermediary.

According to the Ministry of Finance, the Board now collects funds for gold purchases conducted on behalf of clients, including the Bank of Ghana, and earns revenue through service charges and fees for assays conducted prior to export.

In practice, this shift has placed the Bank of Ghana at the centre of GoldBod’s financing.

The Bank had already launched a domestic gold purchase programme in June 2021, partnering with the Precious Minerals Marketing Company, now GoldBod, to buy gold doré from local miners in cedis, refine it abroad for Ghana’s reserves or sell it and add the foreign exchange proceeds to reserves.

This programme was branded Gold for Reserves. What exists today is effectively an expanded version of that arrangement.

According to the Bank of Ghana, it supports GoldBod’s operations through two main channels.

In the first, the Bank collects cedis from commercial banks and forwards the funds to the Gold Board to purchase gold from small scale miners. The gold is then sold and the dollar proceeds are returned to the Bank, which supplies the commercial banks with foreign exchange.

In the second channel, the Bank uses “high powered money” to purchase gold directly from GoldBod. The gold is either sold for foreign exchange, which is added to reserves, or refined and added to Ghana’s gold holdings.

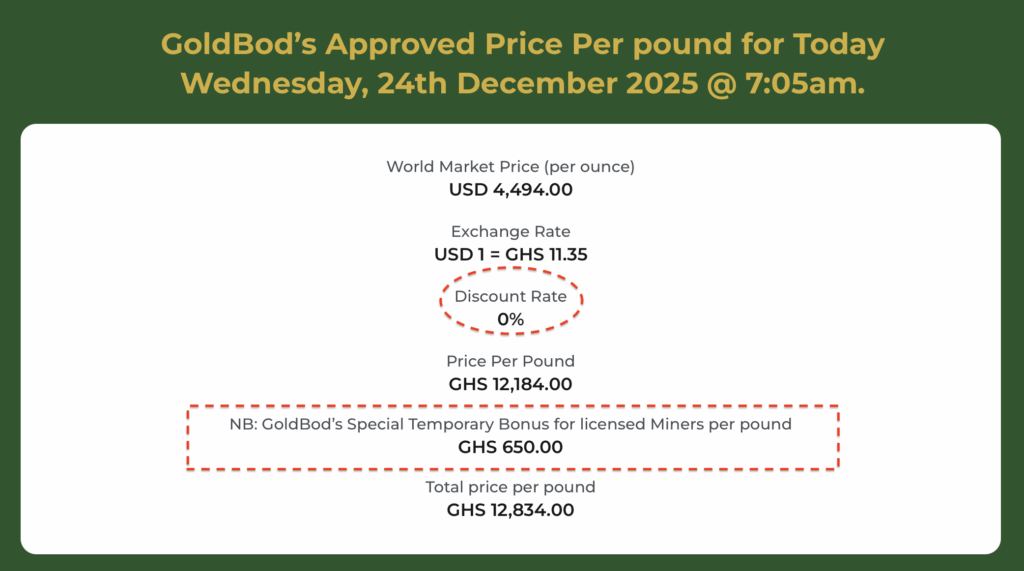

The core source of the losses lies in how GoldBod prices gold purchases and sales.

GoldBod buys gold from small scale miners at the prevailing world market price. In some cases, it pays above the spot price in an effort to discourage smuggling.

The gold purchased, however, is unrefined. When Ghana exports this gold, it does not receive the full world market price.

This is because gold doré typically trades at a discount to account for refining, assay risk, transport, and financing costs.

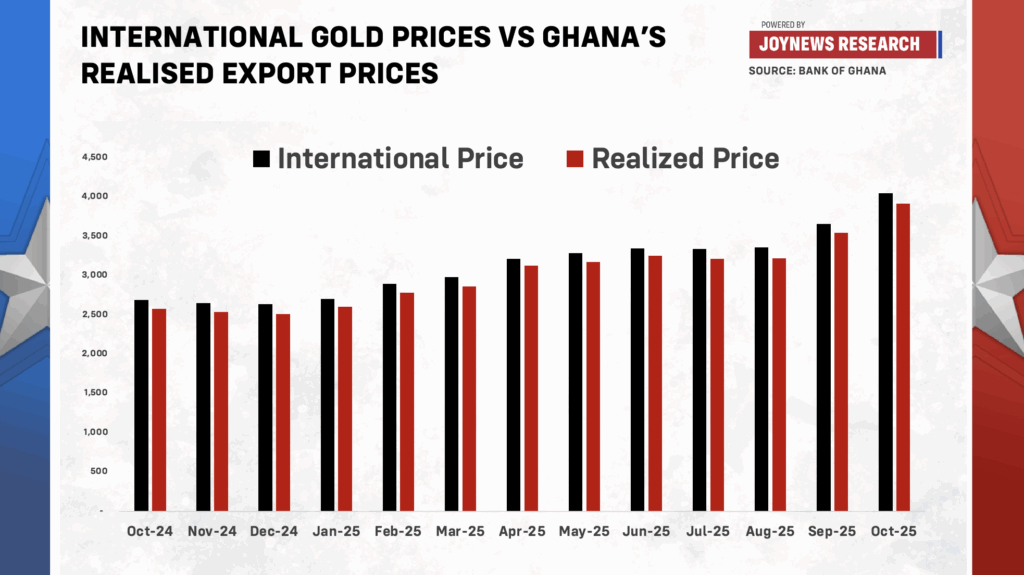

Data tracked by JoyNews Research using official figures from the Bank of Ghana show that Ghana has historically sold its gold at a discount of 3% to 5% on the international market.

In October 2025, for example, the average world price of gold was $4,054 per ounce, yet Ghana realised about $3,919 per ounce. That represents a shortfall of roughly $135 per ounce, or about 3%.

In practical terms, this means that GoldBod buys gold from miners at $4,054 per ounce and sells it internationally at $3,919 per ounce. That price difference alone generates a loss.

On top of this, the Bank pays GoldBod a 0.5% ad valorem service fee and a 0.258% assay fee.

To date, according to data from GoldBod, the Bank of Ghana has paid GoldBod more than ₵827 million in total charges.

When trading losses and service fees are combined, losses become almost unavoidable for the Bank of Ghana.

This outcome runs counter to the original logic of the GoldBod model.

When the Gold Board was proposed, the assumption was that gold would be purchased from miners at a discount, allowing the margin and service fees to cover operational costs.

As the CEO of GoldBod, Sammy Gyamfi, said on JoyNews’ PM Express on March 25, 2025, before GoldBod became operational, “nobody buys gold at spot price…Since time immemorial, since we were born or since Ghana became Ghana, everybody buys gold at a discount. The discount must be fair.”

Buying gold at a premium and selling it at a discount is mathematically unsustainable.

Under the current structure, GoldBod avoids the trading losses by transferring the financial burden to the central bank.

The Board collects fees and licensing income while the Bank of Ghana absorbs both the trading losses and the balance sheet risk.

Goldbod has delivered short term macroeconomic benefits. Ghana has generated over $10 billion in foreign exchange through gold exports, supporting the cedi, strengthening reserves and helping to meet debt service obligations while containing inflation.

However, the IMF has cautioned that this financing model cannot be sustained indefinitely. As the Fund put it, “Losses from the domestic gold purchase programme and GoldBod’s activities should not be borne by the central bank.”

Looking ahead, the structure of the programme may change.

According to the Chief Executive Officer of GoldBod, the Board is expected to fully take over the artisanal and small scale gold trading programme from January 2026, meaning GoldBod would no longer operate as an intermediary for the Bank of Ghana.

Under this arrangement, GoldBod would be responsible for purchasing, trading and selling gold directly, with no fee obligations to the central bank.

However, further clarity is still required on how this new model will operate in practice.

Questions remain over whether central government will finally release the $279 million revolving fund allocated in the 2025 budget and, most importantly, whether GoldBod will move away from buying gold at spot prices or premiums.

Until these issues are resolved, it remains unclear whether the underlying sources of the current losses will be fully addressed.

Unless Ghana resolves the contradiction of paying miners full world market prices while exporting gold at a discount, the cost of maintaining the programme will continue to surface somewhere in the system.

For now, that cost sits squarely on the balance sheet of the central bank.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More