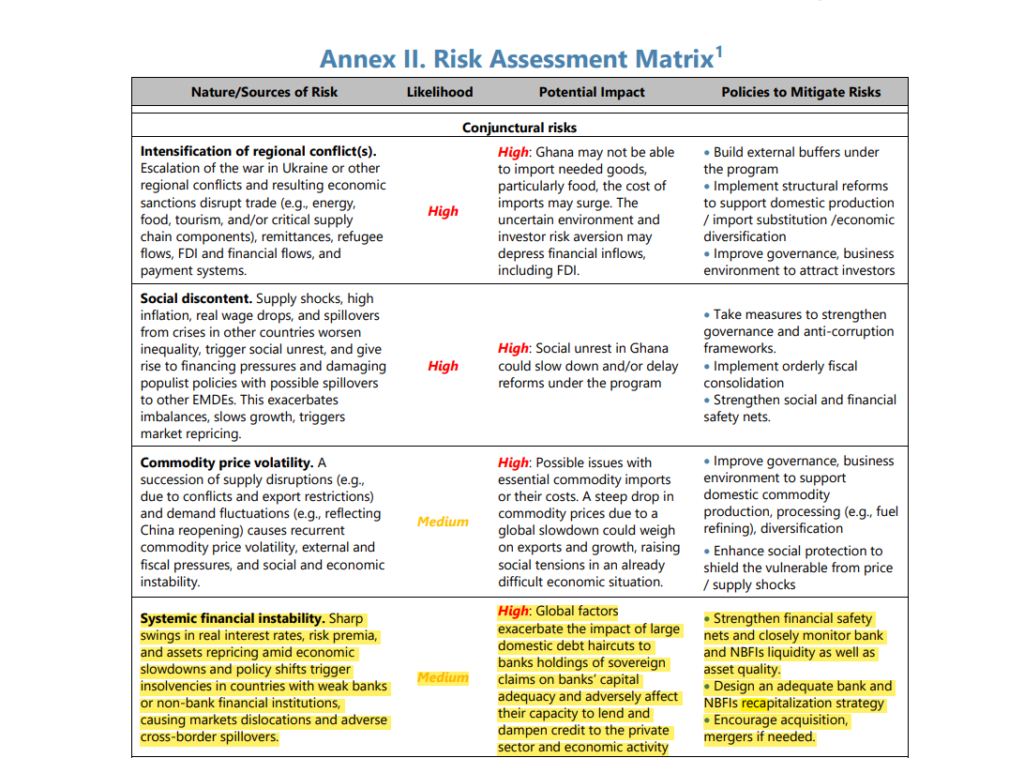

The International Monetary Fund (IMF) has proffered three policies including acquisitions and mergers of banks and non-banks to mitigate the possible systematic financial instability in Ghana.

These policies captured under the Risk Assessment Matrix contained in the recent IMF country report on Ghana, aim to mitigate risks and ensure the stability of the banking and Non-Bank Financial Institutions (NBFIs).

The first policy suggests strengthening financial safety nets and closely monitoring the liquidity and asset quality of banks and NBFIs.

The second policy involves designing an appropriate strategy to recapitalize banks and NBFIs. Lastly, the IMF encourages acquisitions and mergers as a means to address any necessary consolidation in the financial space.

- “Strengthen financial safety nets and closely monitor bank and NBFIs liquidity as well as asset quality.

- “Design an adequate bank and NBFIs recapitalization strategy

- “Encourage acquisition, mergers if needed”

According to the IMF, countries with weak banks and non-bank financial institutions are at risk of insolvencies when they experience significant fluctuations in real interest rates, risk premia, and asset prices. These fluctuations are often observed during economic slowdowns and policy changes.

The IMF emphasises that such insolvencies can have far-reaching consequences, causing disruptions in markets and unfavourable effects that extend beyond national borders.

“Sharp swings in real interest rates, risk premia, and assets repricing amid economic slowdowns and policy shifts trigger insolvencies in countries with weak banks or non-bank financial institutions, causing markets dislocations and adverse cross-border spillovers” It stressed.

Although the likelihood of this happing in tagged as MEDIUM, the Fund, however, indicated that global factors have intensified the consequences of substantial reductions in domestic debt on banks’ capital adequacy. These haircuts directly impact the banks’ holdings of sovereign claims and have adverse effects on their ability to lend. As a result, this situation hampers credit availability for the private sector and ultimately dampens economic activity – the potential impact on Ghana’s financial sector could be HIGH.

The IMF also revealed the recent Domestic Debt Exchange Programme (DDEP) in Ghana which exchanged old sovereign bonds for new ones has affected the health of the country’s financial sector. Banks and other financial institutions had invested a significant amount of money in government bonds, but now the government has reduced the interest rates and extended the time they have to be paid back. As a result, the value of these bonds has decreased, causing financial institutions to face a significant financial challenge.

“Domestic bonds were widely distributed across the financial sector in Ghana, representing the most important asset class held by commercial banks, pension funds, asset management companies, and insurance companies. Banks held 30 to 50 per cent of their total assets in government securities before the DDEP—with especially high exposures in the state-owned banks—and relied significantly on income from these securities.

The coupon reductions and maturity extensions in the recently completed DDE mean that the value of these assets will decline to about 70 per cent of the par value. This revaluation represents a significant shock to the balance sheets of these financial institutions” the report indicated.

In announcing the success of the DDEP, government indicated it was putting plans in place to establish a GH₵15 billion ($1.5 billion) Ghana Financial Stability Fund (GFSF) which will be supervised by the Bank of Ghana. The GFSF is to provide liquidity to banks that participated in the DDEP. The World Bank has committed $250 million to support the racialization plan with the remaining amount expected to be funded by government.

According to the IMF report, “government solvency support will be designed to minimize costs and moral hazard, incentivise private capital injections, foster structural reforms improving operational efficiency, and allow for an orderly, early government exit.

When acting in its capacity as shareholder, i.e., for state-owned banks, the government will frontload any necessary recapitalizations of state-owned banks, which will be underpinned by credible plans to ensure the future viability and a level playing field with private banks.”

Ghana’s financial sector has already gone through a lot of turmoil during the 2017 banking sector clean-up which saw a reduction in the number of banks operating in Ghana from 34 to 23, whilst 347 micro-finance institutions, 15 savings and loans, and 8 finance houses had their licenses revoked. This exercise cost the state about GH¢25 billion and takes a pivotal position in Ghana’s sustainable debt portfolio.

The IMF country report on Ghana has disclosed that “the fiscal cost of the financial sector recapitalization (estimated to have reached 7.1 per cent of GDP over 2017-21) has led to an increase in the government deficit and debt. Additional recapitalization costs are expected in the coming years resulting from the domestic debt restructuring envisaged in 2023—some 2.6 per cent of GDP are included in the DSA’s baseline.”

Banks operating in Ghana have up to September 2023 to provide their respective recapitalisation plans to the Bank of Ghana.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policies of Homebase Television Ltd.

- President Commissions 36.5 Million Dollars Hospital In The Tain District

- You Will Not Go Free For Killing An Hard Working MP – Akufo-Addo To MP’s Killer

- I Will Lead You To Victory – Ato Forson Assures NDC Supporters

Visit Our Social Media for More